From June to September 2024

2024 London Quantitative Finance Summit

During his tenure at Morgan Stanley

Founded in 2008, Verition is a multi-strategy hedge fund headquartered in the United States, with offices in major global financial centers including New York, London, and Singapore. The firm manages approximately USD 7–10 billion in assets and focuses on a wide range of strategies, including equity long/short, event-driven, relative value, macro and rates, credit, and quantitative/systematic approaches. Verition operates under a multi-PM platform model similar to Citadel and Millennium. All portfolio managers operate under independent risk budgets, with a centralized risk management team providing real-time monitoring to ensure stability and transparency across the strategy portfolio. Supported by an integrated data and quantitative infrastructure, Verition has earned long-term trust from global institutional investors—including pension funds, endowments, sovereign wealth funds, and family offices—and is recognized as one of the fastest-growing and most established multi-strategy platforms in the industry.

-

Image

Brian John Murphy

Education

Education

Born in Canada, Mr. Murphy earned his Bachelor’s degree in Finance from the University of British Columbia (UBC) and his Master of Finance in Financial Engineering from the MIT Sloan School of Management. He is also a CFA charterholder. His areas of expertise include quantitative research, macro analysis, and cross-market trading.

Professional Experience Mr. Murphy previously served in J.P. Morgan’s North America Multi-Asset Research Division, where he conducted research on U.S. and Canadian equities, interest rates, credit, and commodities, and contributed to the development of the North American risk-factor model.

He later joined BlackRock’s Systematic Investing Group as a Senior Strategist, focusing on quantitative equity selection, ETF factor strategies, and cross-market arbitrage. His research has been published in Institutional Investor and Risk Magazine.

Role at Verition – SCJP Mr. Murphy contributes to the development of North American and Canadian multi-strategy investment frameworks, working closely with the equity, rates, credit, quantitative, and derivatives teams. His responsibilities include building multi-asset quantitative model architectures, advancing AI applications in investment strategies, optimizing risk budgets and capital allocation structures, and serving clients such as Canadian pension funds, endowments, and family offices.

Representative Performance In periods of elevated market volatility, the multi-strategy portfolios under his involvement have delivered strong risk-adjusted returns and significantly outperformed major U.S. and Canadian benchmarks during several market cycles.

Investment Style Quantitatively driven, AI-supported analysis, cross-asset allocation, with a strong emphasis on systematic risk management and tail-risk control.

-

Image

Brian John Murphy Appointed Chairman of the Verition Canada Fund Advisory Board

Release Date: May 1, 2025

Release Date: May 1, 2025

Verition has appointed veteran investor Brian John Murphy as Chairman of the Advisory Board for its Canada Fund. In this role, he will oversee the preparation and compliance framework for Verition’s first Canadian hedge fund and work closely with SCJP Trust Management Ltd. in Toronto to advance the firm’s strategic initiatives in Canada.

The collaboration between Verition and SCJP combines global research expertise with local execution capabilities, ensuring both stability and regulatory compliance for the fund. This partnership signifies Verition’s official entry into the Canadian market and lays a solid foundation for the fund’s planned launch in May 2026.

-

Image

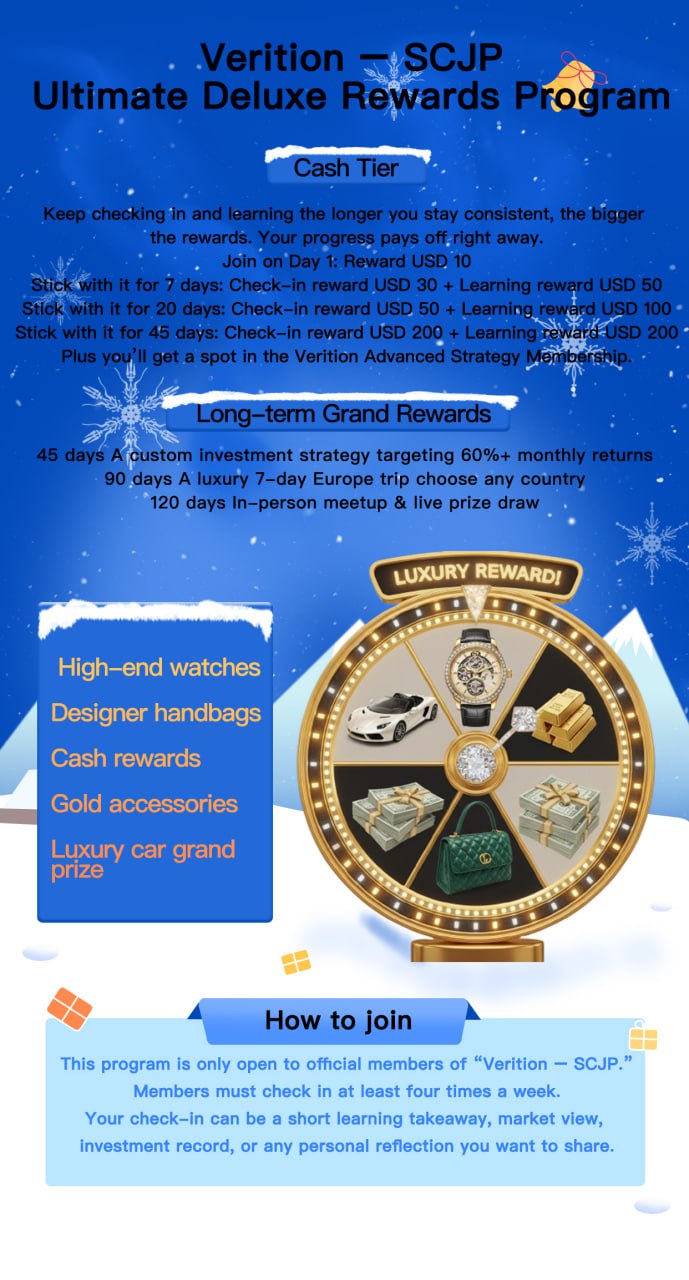

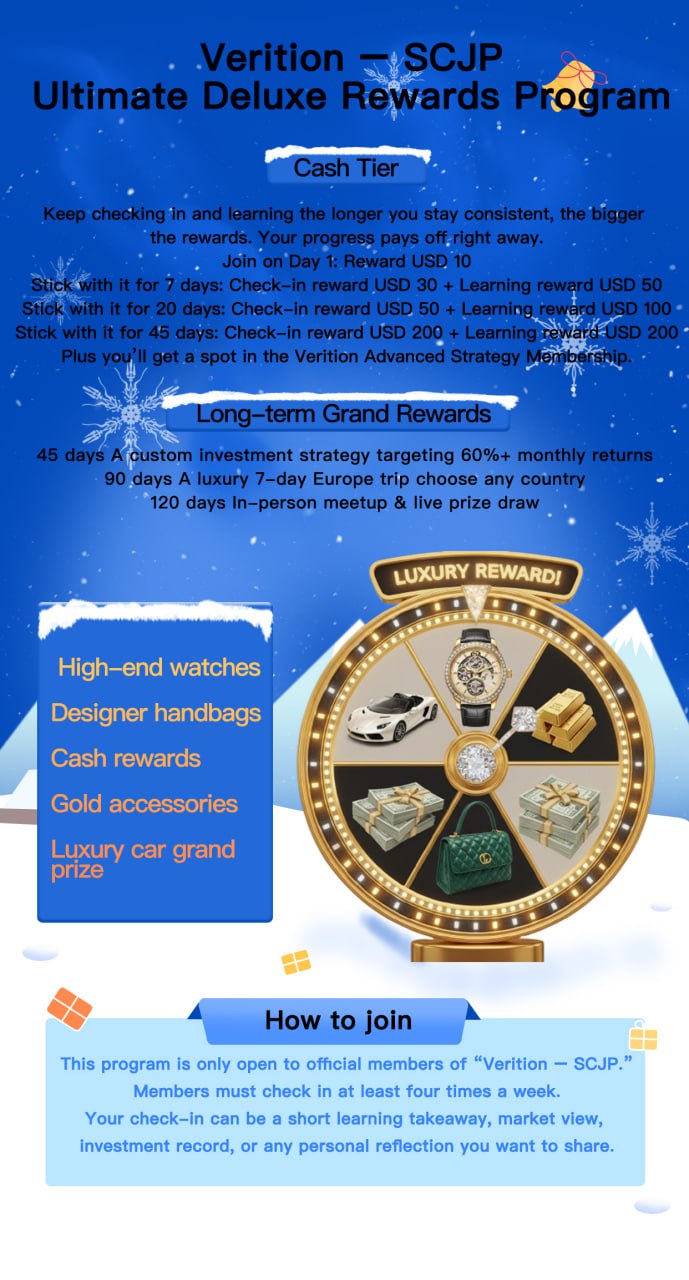

Verition and SCJP Launch the “Verition Elite Circle – SCJP Rewards Program” to Expand Market Presence in Canada

Release Date: November 1, 2025

Release Date: November 1, 2025

To further advance their localized development in Canada, Verition and SCJP have jointly launched the Verition Elite Circle – SCJP Rewards Program.

This initiative integrates learning with interactive engagement, aiming to help investors deepen their understanding of quantitative trading and risk management while offering both cash and physical rewards. Members can earn regular incentives through daily check-ins and course participation, with top performers eligible for premium gifts and grand prizes.

The program marks the official start of Verition and SCJP’s collaboration in the Canadian market, providing investors with a new experience that combines education with practical application.

Brian John Murphy

Education

Born in Canada, Mr. Murphy earned his Bachelor’s degree in Finance from the University of British Columbia (UBC) and his Master of Finance in Financial Engineering from the MIT Sloan School of Management. He is also a CFA charterholder. His areas of expertise include quantitative research, macro analysis, and cross-market trading.

Education

Born in Canada, Mr. Murphy earned his Bachelor’s degree in Finance from the University of British Columbia (UBC) and his Master of Finance in Financial Engineering from the MIT Sloan School of Management. He is also a CFA charterholder. His areas of expertise include quantitative research, macro analysis, and cross-market trading.

Professional Experience Mr. Murphy previously served in J.P. Morgan’s North America Multi-Asset Research Division, where he conducted research on U.S. and Canadian equities, interest rates, credit, and commodities, and contributed to the development of the North American risk-factor model.

He later joined BlackRock’s Systematic Investing Group as a Senior Strategist, focusing on quantitative equity selection, ETF factor strategies, and cross-market arbitrage. His research has been published in Institutional Investor and Risk Magazine.

Role at Verition – SCJP Mr. Murphy contributes to the development of North American and Canadian multi-strategy investment frameworks, working closely with the equity, rates, credit, quantitative, and derivatives teams. His responsibilities include building multi-asset quantitative model architectures, advancing AI applications in investment strategies, optimizing risk budgets and capital allocation structures, and serving clients such as Canadian pension funds, endowments, and family offices.

Representative Performance In periods of elevated market volatility, the multi-strategy portfolios under his involvement have delivered strong risk-adjusted returns and significantly outperformed major U.S. and Canadian benchmarks during several market cycles.

Investment Style Quantitatively driven, AI-supported analysis, cross-asset allocation, with a strong emphasis on systematic risk management and tail-risk control.

Brian John Murphy Appointed Chairman of the Verition Canada Fund Advisory Board

Release Date: May 1, 2025

Release Date: May 1, 2025

Verition has appointed veteran investor Brian John Murphy as Chairman of the Advisory Board for its Canada Fund. In this role, he will oversee the preparation and compliance framework for Verition’s first Canadian hedge fund and work closely with SCJP Trust Management Ltd. in Toronto to advance the firm’s strategic initiatives in Canada.

The collaboration between Verition and SCJP combines global research expertise with local execution capabilities, ensuring both stability and regulatory compliance for the fund. This partnership signifies Verition’s official entry into the Canadian market and lays a solid foundation for the fund’s planned launch in May 2026.

Verition and SCJP Launch the “Verition Elite Circle – SCJP Rewards Program” to Expand Market Presence in Canada

Release Date: November 1, 2025

Release Date: November 1, 2025

To further advance their localized development in Canada, Verition and SCJP have jointly launched the Verition Elite Circle – SCJP Rewards Program.

This initiative integrates learning with interactive engagement, aiming to help investors deepen their understanding of quantitative trading and risk management while offering both cash and physical rewards. Members can earn regular incentives through daily check-ins and course participation, with top performers eligible for premium gifts and grand prizes.

The program marks the official start of Verition and SCJP’s collaboration in the Canadian market, providing investors with a new experience that combines education with practical application.

Consult previous events by selecting the "Show Past events" filter above.

Consult previous events by selecting the "Show Past events" filter above.

SCJP Trust Management Ltd. is incorporated in the Province of Ontario under the Ontario Business Corporations Act and specializes in fund operations and compliance management. As an investment fund manager, SCJP is registered under Canadian securities regulation NI 31-103 with the Ontario Securities Commission (OSC) and other provincial regulators, under NRD number 82010. Fund distribution and trade execution are carried out through licensed brokers and dealers regulated by the Investment Industry Regulatory Organization of Canada (IIROC).SCJP remains committed to compliance and prudent business practices. Leveraging Canada’s robust regulatory framework and custodial arrangements, the firm provides reliable fund management and compliance services to institutional and high-net-worth clients.

Brian John Murphy is a Canadian citizen and a Chartered Financial Analyst (CFA), having obtained the designation on February 9, 2000. He currently serves as Managing Partner of SCJP Trust Management Ltd. and concurrently as Chairman of the Verition Canada Fund Advisory Board. In these roles, he is responsible for overseeing the fund’s compliance, establishment, and operations within the Canadian market, ensuring adherence to local regulatory requirements. He also supports Verition’s strategic initiatives in Canada and helps meet the needs of local investors.